Generated Title: Standard Chartered CEO's Blockchain Bonanza: Or How I Learned to Stop Worrying and Love the Hype

The End of Money As We Know It? Please.

Okay, so Standard Chartered CEO Bill Winters is now apparently Nostradamus, predicting that "pretty much all transactions will settle on blockchains eventually, and that all money will be digital." Right. Give me a break.

I mean, sure, the guy's got a vested interest in pumping up crypto. Standard Chartered's "ramping up its involvement with digital assets," according to the press release... sorry, I mean, news. Digital asset custody, trading platforms, tokenized products – the whole shebang. Ofcourse he's gonna say blockchain is the future. He's selling the shovels in this digital gold rush.

But let's be real. "A complete rewiring of the financial system"? That's what they always say. It's the same old song and dance we've been hearing since the dot-com bubble. Remember when the internet was going to change everything? It changed some things, sure, mostly the way we argue with strangers and order takeout. But it didn't exactly abolish nation-states or bring about world peace, did it?

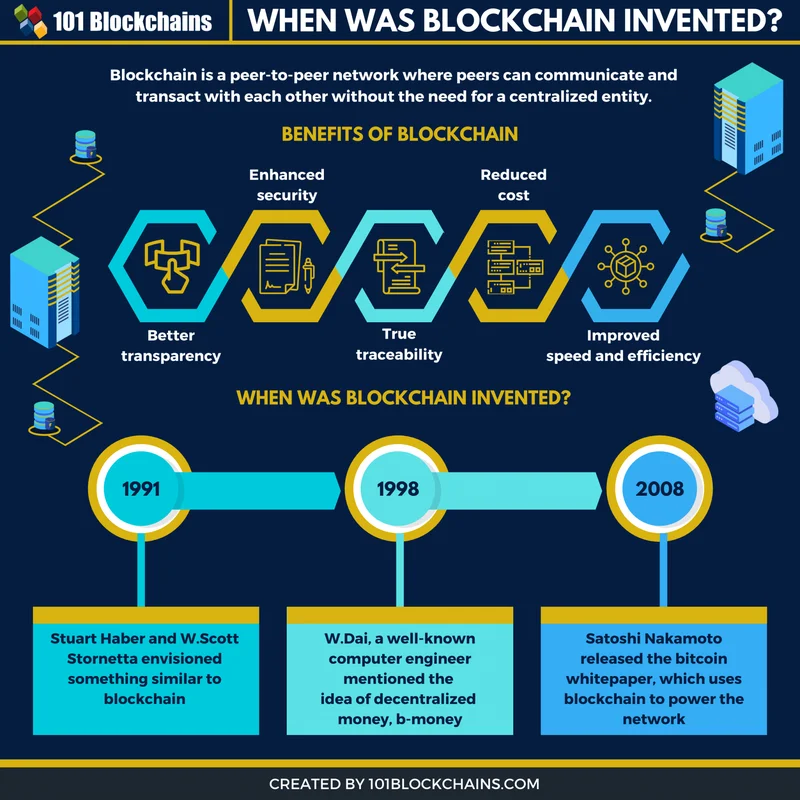

And this blockchain revolution...what problem is it actually solving? Faster transactions? Maybe. More secure? Debatable. More transparent? Only if you understand the byzantine code that underpins it all, which 99.99% of people don't.

Hong Kong's Crypto Hub Dream: Fool's Gold?

Winters also praised Hong Kong's "leadership on experimentation and regulation" in the digital asset space. Because apparently, kowtowing to Beijing while trying to become a crypto hub is a sign of "leadership."

Hong Kong's trying to lure crypto businesses with a digital asset licensing regime and tokenization pilots. Standard Chartered's even participating. It's all very exciting, I'm sure, for the handful of people who understand what "tokenization pilots" even are.

But what happens when Beijing decides crypto is a threat to its control? What happens when the next big crypto crash wipes out fortunes and leaves investors holding the bag? Will Hong Kong still be so eager to be the world's crypto darling then?

I'm just saying, putting all your eggs in the blockchain basket seems like a risky move, especially when that basket is sitting precariously on the edge of a geopolitical cliff.

Speaking of risky moves, I still can't believe they discontinued my favorite flavor of seltzer. Mango Lime. Gone. Just like that. What am I supposed to drink now, La Croix? Don't even get me started on La Croix...

The Reality Check We All Need

Look, I'm not saying blockchain is nothing. There might be some legitimate uses for it somewhere down the line. But the hype is out of control. The breathless pronouncements of CEOs and crypto evangelists are divorced from reality.

"Pretty much all transactions will settle on blockchains eventually..."

Really? All of them? Every single coffee purchase, every rent check, every international arms deal? All recorded on a public, immutable ledger? Standard Chartered CEO expects blockchain to ‘eventually’ power nearly all global transactions

I don't know, man. Maybe I'm just too old and jaded. Maybe I'm missing the boat. But something about this whole thing smells fishy. It smells like a bunch of tech bros and venture capitalists trying to create a problem so they can sell you the solution.

This Isn't the Future, It's Just More of the Same

The thing is, this whole "blockchain revolution" is just another way for the rich to get richer and for the rest of us to get screwed. It's the same old game, just with shinier, more confusing technology. Wake me up when it's over.